Simultaneously, farm input prices, particularly fuel and fertiliser, have soared to all-time highs – with few signs that the situation may ease. In most cases, higher output prices justify the investment in inputs. But arable farmers’ exposure to price risk is now greater than ever before – at the same time as traditional farm support is stripped away.

Previous commodity price spikes offer a lesson here in avoiding a dangerous trap. The first big bull run on most grains in 2007-8 was followed by an equally sharp downward correction, as the pressure on the global supply/demand balance eased. In that case, seed, fertiliser and agrochemical prices, which had seen considerable inflation, returned to more normal levels relatively quickly.

In 2022/23, the inflationary pressures on energy sources – all fuel, and, by extension fertilisers, since most nitrogen fertiliser is derived from natural gas – have their own drivers, quite separate from global demand for grains. It is perfectly possible that, if global grain production begins to meet consumption, and stocks recover, farmers’ costs of production will outstrip the return from the market – with farm support payments in England worth about half of 2020 levels.

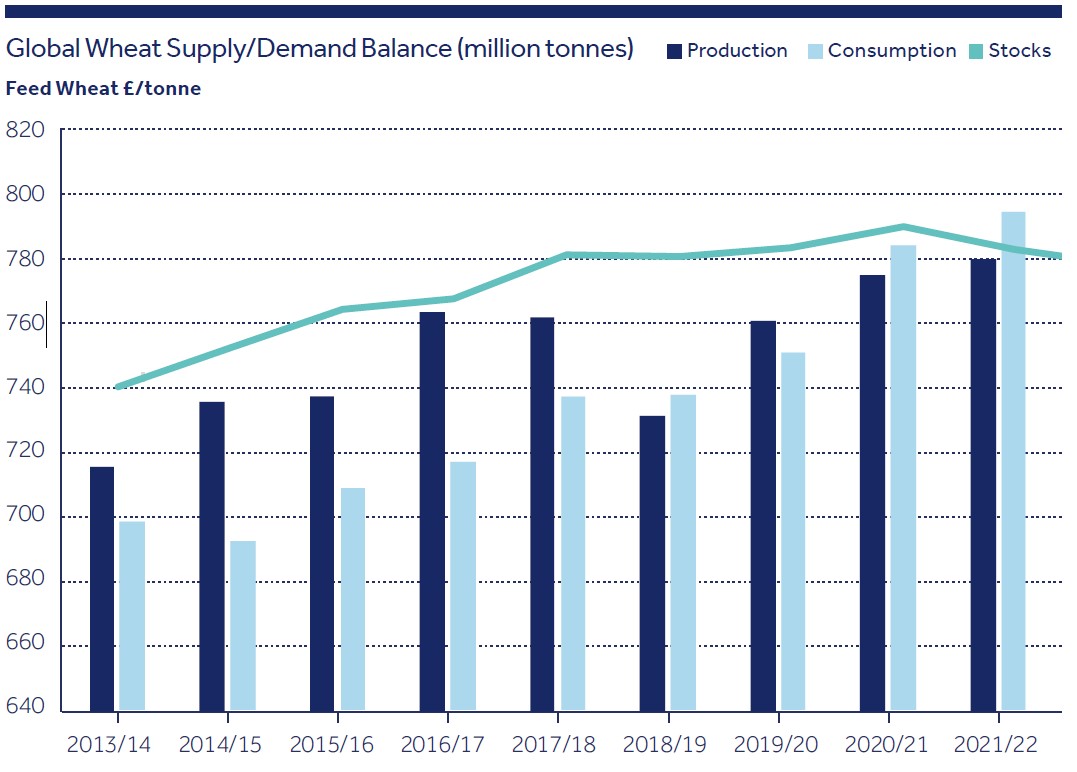

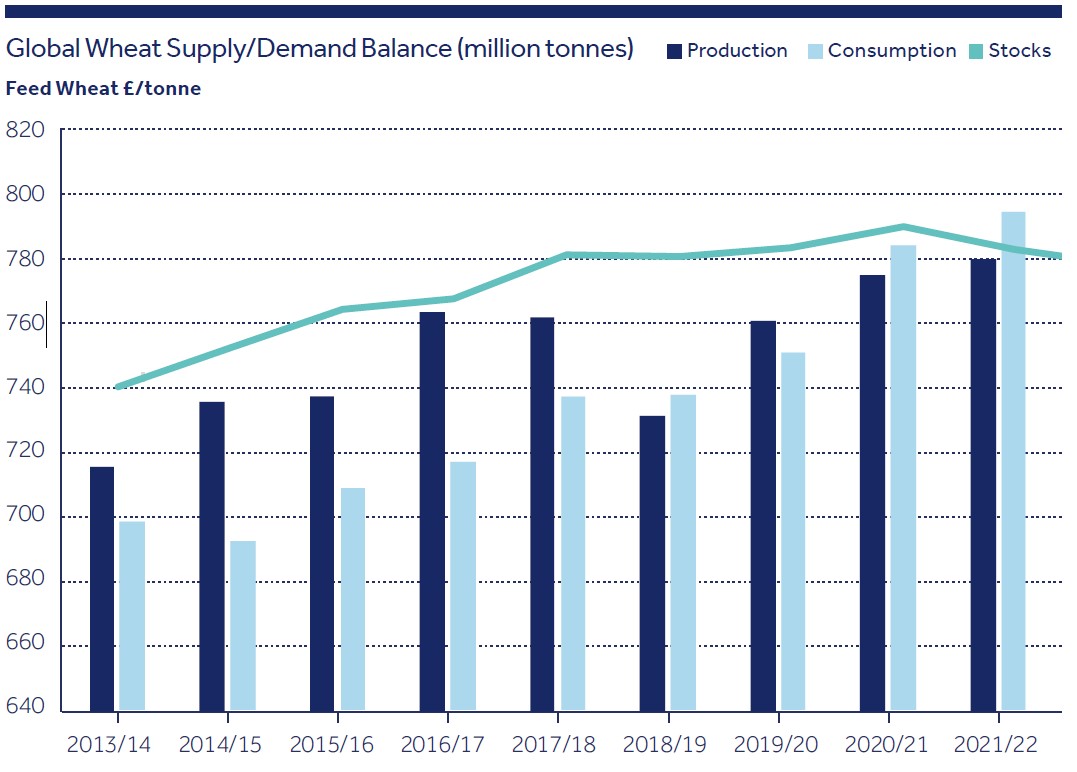

As the graph above shows, the fundamentals of grain markets – supply and demand – had tightened in the two years leading up to the war.

Over the winter months, there has been a bearish sentiment in the market and prices have eased – although the levels at which they have settled remain well above previous “highs”. The grain corridor agreement in the Black Sea appears (at the time of writing) to be sustained, easing some supply concerns, and weakening demand from China due to ongoing COVID restrictions has contributed to this trend. An easing of supply concerns in the vegetable oils market have pulled oilseed rape back below the £500/tonne mark and UK feed wheat is now trading around £240/tonne. Yet, provided crop yields are average or better, these should still generate significant gross margins for most crops.

In parallel with the tight global supply/ demand situation, the world population continues to grow, eclipsing 8bn in 2022. So there is reason to believe that, in general, grain prices will remain well supported going forwards.

In 2021, having purchased inputs at prices that now look very affordable, many combinable crop farmers benefited from low-input costs, high yields, high quality and high crop prices leading to significant profits. With a proper approach to risk management, there is every expectation that 2022 will deliver the same, if not even better. But beyond that the picture is much more opaque. In fear of further rises, many farmers will have secured their 2023 harvest fertiliser at as much as £800/tonne for ammonium nitrate, or well over £2/kg of available nitrogen; this commitment is a heavy bet on crop prices and yields – two factors well beyond the grower’s influence or control.

The strong correlation between future prices for current and subsequent crop years means a price rally for old crop very likely constitutes a selling opportunity for “new crop” too. While prices have come back, and may yet recover lost ground, futures prices for November 2023 or early 2024 mean forward contracts are available to growers to mitigate some of the price

risk. In most cases, crop establishment this autumn was very good and this should give growers the confidence to extend their hedging commitments further than they might in previous years – but since the stakes involved are now so much greater, a business-as-usual approach looks loaded with risk.